Scuba Diving Research

CONTAINED within this section are various studies conducted by Cline Group that are for public release. These studies form the industry’s first and only benchmarks for independent consumer and industry research. Cline Group is available for custom research projects and has conducted over 100 studies to date within the market for various clients. Please contact William Cline for more information or click here to subscribe to our regular mailings.

Cline’s Quarterly Dive Industry Survey is in and a total of 103 dive businesses responded to the survey and indicated the following results here.

Cline’s Quarterly Dive Industry Survey is in and a total of 108 dive businesses responded to the survey and indicated the following results here.

Cline’s Quarterly Dive Industry Survey is in and a total of 153 dive businesses responded to the survey and indicated the following results here.

Cline’s Quarterly Dive Industry Survey is in and a total of 127 dive businesses responded to the survey and indicated the following results here.

Cline’s Quarterly Dive Industry Survey is in and a total of 110 dive businesses responded to the survey and indicated the following results here.

Cline’s Quarterly Dive Industry Survey is in and a total of 94 dive businesses responded to the survey and indicated the following results here.

Cline’s Quarterly Dive Industry Survey is in and a total of 156 dive businesses responded to the survey and indicated the following results here.

Cline’s Quarterly Dive Industry Survey is in and a total of 167 dive businesses responded to the survey and indicated the following results here.

Cline’s Quarterly Dive Industry Survey is in and a total of 151 dive businesses responded to the survey and indicated the following results here.

Cline’s Quarterly Dive Industry Survey is in and a total of 228 dive businesses responded to the survey and indicated the following results here.

Cline’s Quarterly Dive Industry Survey is in and a total of 156 dive businesses responded to the survey and indicated the following results here.

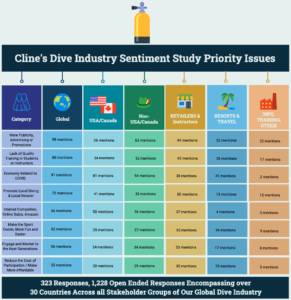

Cline’s 2020 State of The Dive Industry Sentiment Study:

We as an industry are massively changing and it started well before this current global pandemic. We are seeing shifts in training, dive vacation habits and gear purchasing patterns that all point to seismic shifts in our dive consumer base. This survey is looking for the industry’s assessment of where we are going by sector, and what we can do to change some of the trends emerging.

A total of 323 dive business responded to this survey from over 47 countries, generating 1,228 open ended responses. The questions touched some nerves and opinions were offered. Some negative, positive and everywhere in between. There is quantifiable data, that is what the majority said, but the true value of this survey is in what one person said that no one else thought of – or that unique perception that might change the way we think about some ‘gold standards’ in our industry.

We were surprised at many of the comments and responses. Some of you wrote hundreds of words, others just one. But the nature of this kind of sentiment survey is just that – ‘opinion’ and a test our temperature as an industry while we ‘reboot’ our businesses in many cases, as a result of the COVID shutdown. That is a common theme, the entire world was and is negatively affected so for a moment, we are all in the same boat as an industry.

That moment of reflection is what makes this survey unique as we all stopped to think of our companies’ and our personal futures in this industry post-COVID. We have yet to even pass the half-way mark globally on any sort of recovery. In fact, many companies are literally treading water hoping to open or stay open in many cases to generate some revenue.

There were only four questions:

Q1) BEFORE the current COVID pandemic, what did you perceive was the number one threat to your dive business, regardless if it’s internal within the industry or external?

311 Responses

Q2) What do you think we should, as an industry, do to help curb, change or reverse this problem?

309 Responses

Q3) How do you think, we as an industry, can attract more people to the sport?

307 Responses

Q4) What do you think is the best way to bring inactive divers back to the sport?

301 Responses

Cline’s Diving Industry Special Summer 2020 Certification Survey Released, August, 2020:

Cline’s 1st & 2nd Quarter 2020 Quarterly Dive Industry Survey is in and a total of 128 dive businesses responded to this global survey and indicated the following results, Conducted July 2020:

Special COVID #2 Global Business Survey Conducted May 2020.

Special COVID #1 Global Business Survey Conducted April 2020.

View results here: http://x395u.mjt.lu/nl2/x395u/mivlw.html?

NEW! Cline Research and DEMA Release Study on New Dive Industry Professionals

By DEMA Association.

A new research study published by DEMA and conducted by William Cline of the Cline Research Group is being made available to all members of the diving industry. The goal of the study was to learn more about getting new (and often younger) professionals involved with the Diving Industry, DEMA Show and the DEMA Association.

In a study that combined a written survey with a face-to-face focus group, DEMA asked new diving professionals to express their opinions about the future of the industry and the value of DEMA Show and the DEMA Association. Forty new professionals responded to the written survey, and nine new professionals attended a face-to-face group study during DEMA Show 2018.

Important findings from the focus group study include:

- New professionals believe that the industry will grow in the future as younger customers are exposed to the experiences inherent in recreational diving.

- Networking, connections, updating, innovation, social opportunities, knowledge, and face-to-face interaction are important to new professionals in their DEMA Show and Industry experiences.

- Motivations for attending DEMA Show included networking, seeing new products and innovations in diving, and obtaining professional education.

- Data is critical to new professionals. They describe themselves as “data-hungry.”

- New professionals, and especially younger new professionals, want an advanced education – Marketing 202 instead of Marketing 101.

- Critically, participants in the focus group felt that DEMA and DEMA Show could provide the resources to bridge the current generational gap – specifically by providing educational opportunities and social interaction between the generations.

- New professionals see the experiences of current industry members as an asset to everyone and want to learn from these experienced professionals. They also see themselves as a resource for new technologies and ideas.

- Topics in the study also include ways to communicate with new and younger professionals and the new professionals’ desire for mentorships that help bridge innovation and experience.

Download a copy of this new study here.

Having served as Vice-Chairman of DEMA’s Board of Directors and Chair of the Research Committee, DEMA.org has produced some astounding research that is available for free just by being a DEMA member. Multiple studies are available for members, including a global 27,000 consumer dive study here: http://www.dema.org/?page=548

New! Mini eBook Published Articles on the following topics (Download here!):

Cline’s 2011 Dive Retailer Financial Study

This new study is the first of it’s kind and unique to the industry as this study looked at the financial health of retailers in the USA.

CLINE QUARTERLY GLOBAL RESEARCH REPORT

Since 2003, The Cline Global Research Report is sent to dive companies, retailers and independent instructors around the world. Every Quarter, the results are sent free of charge to the industry at large. The purpose of this quarterly survey is to offer tracking and comparative data for how stakeholder groups within the industry performed the previous quarter and how they forecast their future quarters’ business in terms of increases or declines. Please subscribe if you are not already to receive these reports free each quarter.

Linked are all the studies for the last several years:

Cline 2nd Quarter 2016 Diving Industry Panel Study • Dive Retailers • Independent Instructors • Travel & Manufacturing

Cline 1st Quarter 2016 Diving Industry Panel Study • Dive Retailers • Independent Instructors • Travel & Manufacturing

Cline 4th Quarter 2015 Diving Industry Panel Study • Dive Retailers • Independent Instructors • Travel & Manufacturing

Cline 3rd Quarter 2015 Diving Industry Panel Study • Dive Retailers • Independent Instructors • Travel & Manufacturing

Cline 4th Quarter 2014 Diving Industry Panel Study • Dive Retailers • Independent Instructors • Travel & Manufacturing

Cline 3rd Quarter 2014 Diving Industry Panel Study • Dive Retailers • Independent Instructors • Travel & Manufacturing

Cline 2nd Quarter 2014 Diving Industry Panel Study • Dive Retailers • Independent Instructors • Travel & Manufacturing

Cline 1st Quarter 2014 Diving Industry Panel Study • Dive Retailers • Independent Instructors • Travel & Manufacturing

Cline 4th Quarter 2013 Diving Industry Panel Study • Dive Retailers • Independent Instructors • Travel & Manufacturing

Other years archived. This study was started in 2001.

——————————————————————————–

HISTORICAL STUDIES conducted by Cline:

Diving Manufacturer and Travel Industry Retailer Study • Retail Purchasing Habits • Total Dive Industry Sales Projections (Released October 1993, Updated July 1995)

Diving Industry Consumer Study • Manufacturing brands and Perceptions Study • Dive Travel Psychographics Study • Diver Activity Perceptions Study (Released December 1997)

Additional Studies and Information:

Contact William Cline for additional non-published research in a variety of subjects.

Data collected and reported by above sources complied by William Cline.